FOR EVERY MARKET SCENARIO THE RIGHT PRODUCT

A certificate is a financial product issued by a bank that allows you to speculate on the price performance of a specific underlying. Certificates are leveraged financial products which, in addition to directional trades, also offer the possibility of speculating on the sideways movement of a market. Whether stocks, indices, commodities or currencies: For almost every market, numerous certificates from all well-known issuers are available to you at CapTrader. The offer includes various types of certificates, such as knock-outs, discount certificates, basket certificates and bonus certificates.

Fair conditions - favorable and transparent

Trading via the Stuttgart and Frankfurt stock exchanges

European and Asian certificates

Large selection of certificates and warrants

Free analyses & further training offers

Modern trading software with numerous order types

Multiple test winner

0 EUR Custody account management

Global trade

Excellent platforms

CERTIFICATES AND WARRANTS AT PERMANENTLY FAVORABLE CONDITIONS

As in other trading categories and for basically all asset classes, favorable conditions have priority for us: You can trade warrants and certificates at CapTrader from as little as 6.00 euros - the minimum of what we charge is just 0.20 percent of the transaction volume per trade.

SHARES, BONDS & CO WITH MORE DYNAMISM TRADE

Certificates track the performance of specific securities or financial products such as indices. Unlike a fund, the buyer of a certificate does not acquire a share in a portfolio, but a debt security of the issuer. Thanks to their versatility, they can be used by investors for trading and hedging positions.

GERMANY

Certificates can be purchased on each trading day from 09:00 to 20:00 CET. are traded on the German stock exchanges in Stuttgart and Frankfurt.

EUROPE

In addition, European certificates are also tradable on Euronext France (SBF) and the Dutch Euronext NL Stocks (AEB).

ASIA

Asian certificates are offered for trading on the Hong Kong Stock Exchange (SEHK).

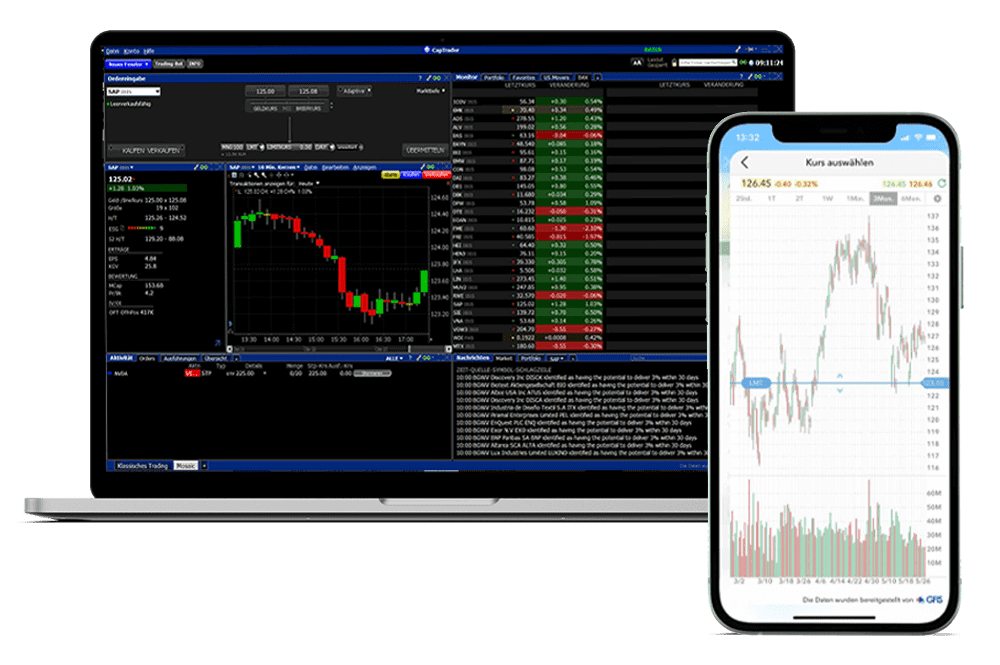

POWERFUL TECHNOLOGY

Our trading platforms offer features that meet the needs of both occasional investors and active traders. Benefit from the performance and user-friendliness of our platforms and trade warrants and certificates from any location via CapTrader.

Trading platform stable even in turbulent stock market times

Over 60 order types and algorithms

Free professional trading tools

Professional trading app available for iOS & Android

OPEN A CUSTODY ACCOUNT NOW AND START MORE DYNAMICS TRADE

Trade warrants and certificates from various providers on the Frankfurt and Stuttgart stock exchanges - as always at CapTrader at particularly favorable conditions.

FREQUENTLY ASKED QUESTIONS ABOUT CERTIFICATES

For more information, please visit our Help Center

How do certificates work?

Certificates are leveraged financial products issued by a financial institution. Legally, they are bearer bonds, i.e. you lend money to the issuer by purchasing a certificate. The price development of the security is linked to the price development of an underlying asset. There are different types of certificates, which can be used for different purposes.

For whom are certificates suitable?

Certificates are products for private traders and are particularly suitable for short to medium-term oriented active traders. Due to the enormous variety of products, a certain basic knowledge and experience is necessary to trade successfully with certificates.

What is the difference between a certificate and a warrant?

The pricing of a warrant is not linear to the price development of the underlying. The reason for this is that the volatility of the underlying also has an influence on the price of the warrant. Certificates, on the other hand, develop linearly with the price of the underlying. In addition, certificates do not have an expiration date and therefore do not suffer any loss of time value.

What is the difference between a certificate and a CFD?

Certificates as well as CFDs are trading instruments whose price development depends on that of the underlying asset. While certificates are issued by a bank and are bearer bonds, a CFD can be traded directly at a CFD broker and represents a kind of contract between broker and trader.

Where are certificates traded?

Certificates are issued by banks and can be traded over-the-counter directly with the issuer. They can also be traded on some stock exchanges. In particular, the Frankfurt Stock Exchange and the Stuttgart Stock Exchange with its EUWAX trading segment are well-known trading venues for certificates.