FUTURES TRADE WORLDWIDE

Among active traders, futures are often the first choice product. There are several reasons for this: Futures are standardized exchange-traded forward contracts. This means trading takes place directly between market participants and there is no need for an issuer. Trading in a futures contract is a type of contract between buyer and seller and occurs whenever a buyer's offer and a seller's offer meet in the exchange's order book. Trading takes place on regulated futures exchanges, which are subject to the rules of the relevant exchange supervisory authority. In addition, most futures can be traded very liquidly, since for many underlyings a high trading volume is available almost around the clock.

CapTrader gives you direct access to more than 35 futures exchanges around the world, including the largest trading venues, such as EUREX, NYMEX and CME.

Futures at favorable and transparent conditions

Trading on the most popular futures exchanges

Futures trading in more than 35 market centers around the world

Comprehensive range of order types, algorithms and trading tools

Modern trading software with numerous order types

Free analyses & further training offers

Multiple test winner

0 EUR Custody account management

Global trade

Excellent platforms

What are futures and for whom are they suitable?

Futures are exchange-traded forward contracts and are used by private and professional traders for trading. Originally, futures were developed to offer market participants the opportunity to hedge against price fluctuations. Commercial traders (so-called hedgers) such as producers and processors of commodities still use futures for hedging. Active traders, on the other hand, use futures mainly to profit from the price fluctuations of a market on a speculative basis. Besides commodities, futures can also be used to trade currencies, bonds and stock indices. In recent years, exchanges have increasingly introduced mini and micro futures. These allow traders with comparatively small accounts to access "real exchange trading" with futures.

CAPTRADER FUTURE-SPECIALS

Mini-Dax® Futures

At one-fifth of the previous contract value (of €5), this contract is much more manageable than the classic DAX futures and is particularly suitable for smaller accounts.

US Micro E-Mini Futures

Micro E-Mini futures provide all traders with easy and more cost-effective access to the equity index futures markets on leading U.S. indices.

Bitcoin Futures

At CapTrader, you have efficient and cost-effective options to trade the leading cryptocurrency as futures directly on the exchange.

OTHER TRADABLE FUTURES

FAVORABLE CONDITIONS AND A VARIETY OF UNDERLYINGS

Put more of your investment capital to work and pay less in brokerage fees thanks to our industry-low commission structure and financial compensation programs. As a result, you get potentially higher returns. Futures orders are settled on a contract-by-contract basis through CapTrader.

A BRIEF PROFILE OF THE BEST-KNOWN FUTURE STOCK EXCHANGES

Trade professionally futures on the largest exchanges on stocks, indices, commodities such as oil, options and many more. At CapTrader you only deposit the margin of the respective exchange.

EUREX Germany

Europe's largest futures exchange. Well-known futures contracts such as the Dax, EURO STOXX and Bund futures are traded here. For Eurex you can use the Margin calculator query the current margin rates.

Chicago Board of Trade CBOT

It is the largest commodity exchange in the world for trading corn, soybeans, oil, rice, wheat, oats, gold and silver.

Chicago Merchantile Exchange CME

The CME is one of the leading futures and options exchanges. Corn, wheat, soybeans, oats, pork bellies, hogs and cattle are traded here.

New York Board of Trade NYBOT

At NYBOT, the focus is on commodity trading in cocoa, coffee, sugar, cotton and orange juice.

New York Mercantile Exchange NYMEX

NYMEX is an exchange formed from the merger in 1994 of the New York Mercantile Exchange and the Commodity Exchange of New York - here market participants trade futures and options in oil, gas and precious metals such as platinum, palladium, silver, gold, industrial metals such as aluminum and copper.

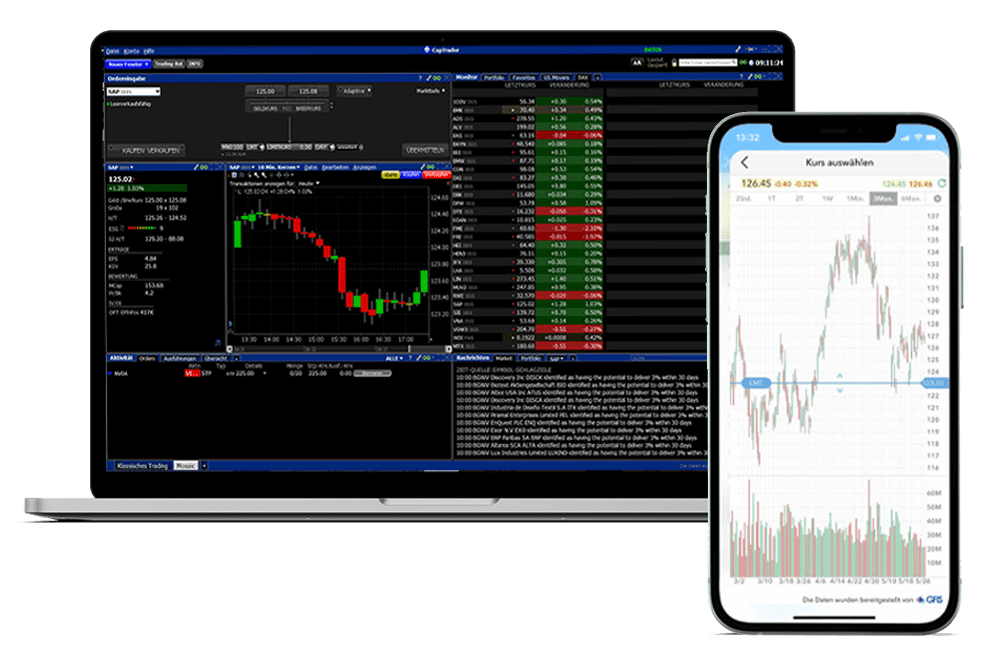

THE RIGHT TOOL TO FUTURE TRADING

With the Trader Workstation, CapTrader offers you a trading platform that also shows its strengths in futures trading. Thanks to its high technical stability as well as the multitude of order types and tools, this top-class solution offers investors the necessary reliability and flexibility that are the basis of successful futures trading.

This allows you to be active in the world's major futures markets from a single account.

OPEN A SECURITIES ACCOUNT NOW AND FUTURES TRADE WITH CAPTRADER

Trade futures on a variety of underlying assets - stocks, indices, commodities such as oil and many more.

A comprehensive range of order types, algorithms and trading tools will help you achieve the optimum in trading and risk management.

FREQUENTLY ASKED QUESTIONS ABOUT FUTURES TRADING

For more information, please see our Trading Academy and the Help Center

How do futures work?

Futures are derivative financial contracts that obligate the buyer and the seller to trade an underlying asset (a commodity, a currency, etc.) at a predetermined price on a specified date in the future. The buyer agrees to purchase the underlying asset, and the seller agrees to deliver the commodity at the agreed price. In very many cases, there is no physical delivery of the underlying and the result is a cash settlement. With a futures broker such as CapTrader, you are also generally protected from an exercise of the futures and the associated obligations.

Where are futures traded?

Futures are exchange-traded forward contracts. Trading takes place on regulated futures and options exchanges take place around the world. The contract details of each futures are determined by the respective exchange.

What are the main futures exchanges?

In Germany, EUREX is the most important exchange for futures trading. In particular, futures on the DAX and other stock indices are traded here. The most important futures exchanges in the U.S. are the CME, as well as other trading centers belonging to the CME Group, including the NYMEX (New York Mercantile Exchange), the COMEX (New York Commodities Exchange) or the CBOT (Chicago Board Of Trade). Futures on all major indices, commodities, currencies and bonds are traded here.

Can I trade bitcoin futures at CapTrader?

Yes, trading Bitcoin futures is possible via the CME. Enter the abbreviation "BRR" in your TWS and then select "Futures" under the heading "CME CF Bitcoin Reference Rate". You can find more info here.

How can I trade Mini-DAX and Micro-DAX futures via TWS?

To trade Mini or Micro DAX futures, enter "DAX" in the "Financial Instrument" column in the TWS. Now select "Futures". In the menu that then appears, the contract months are displayed. Here, at the very bottom, there is a small drop-down menu where you can select the multiplier. This is preset by default to "25" for the large Dax future. To trade mini or micro contracts, you can simply change the multiplier to "5" or to "1".