YOUR ONLINE BROKER FOR CFD TRADING

Trading with CFDs has gained many followers among stock exchange traders in recent years. Mainly because of the many advantages of these financial instruments over other forms of investment: The chance to achieve above-average profits via leverage, the alternative of betting on both rising and falling prices, and the possibility of doing all this at favorable conditions.

CFD trading at favorable and transparent conditions

Direct electronic access to OTC products

CFDs on shares, currencies/forex, indices and metals with a variety of underlyings

CFDs on around 7,250 equities from the Americas, Europe and the Asia-Pacific region

Simultaneous trading of CFDs and the underlying shares

Efficient CFD reference price system

Multiple test winner

0 EUR Custody account management

Global trade

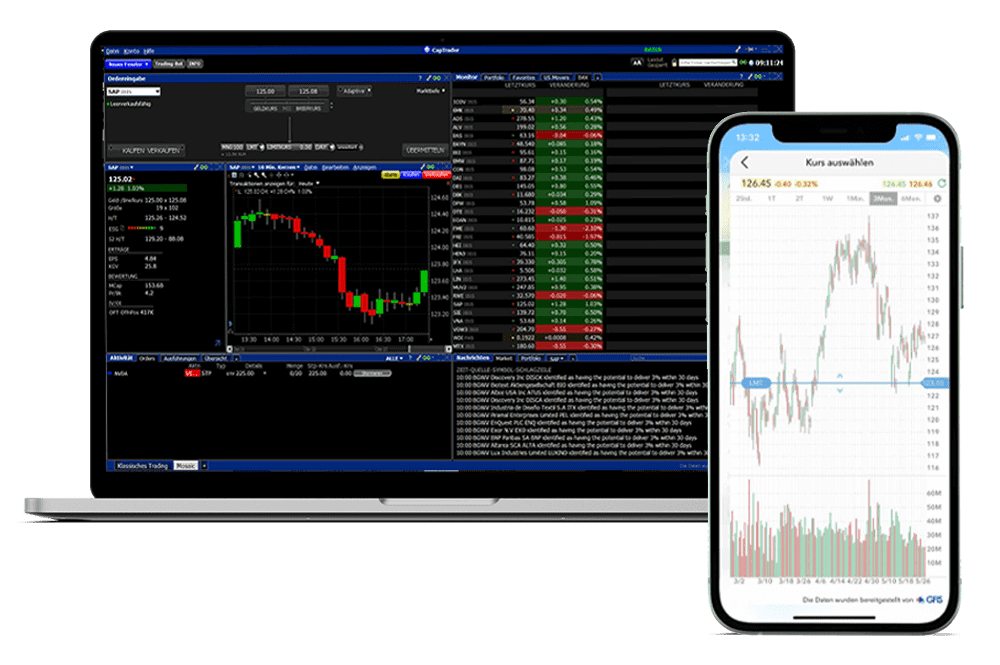

Excellent platforms

CapTrader - Your CFD broker for traders who want more

Trade CFDs through CapTrader with Direct Market Access (DMA). As an established online broker, we guarantee very low fees, narrow spreads and favorable financing costs for contracts for difference, regardless of whether you want to speculate on rising or falling prices of the underlying.

CFDs (Contracts for Difference) are derivatives and are only suitable for very well-informed investors who are aware that the increased opportunities are also associated with increased risks. A derivative or derivative security is a security whose value or performance depends on the performance of one or more underlying assets. The performance of a CFD on the Apple share, for example, will always depend on the development of the price of the Apple share.

OVERVIEW TRADABLE CFDS

At CapTrader you can trade contracts for difference (CFDs) on stocks, indices, metals and Forex - and at very favorable conditions.

Stock CFDs

CapTrader currently offers around 7,000 equity CFDs covering the most important stock exchanges in the USA, Europe and Asia.

Forex CFDs

We owe our tight spreads and strong liquidity to the combination of quote streams from 14 of the world's leading forex dealers.

Index & Metal CFDs

Index CFDs are available for all major stock market indices and precious metal stock indices (London Gold and Silver).

CFDS TO BEST PRICE TRADING

SHARES CFDs

As of: 14.05.2024

Contract interest is calculated daily for all open CFD positions held at the close of trading.

Starting August 1, 2018 an additional spread of 1% will be added to the rates below for clients classified as retail clients under MIFID.

| CFD Stocks Country | Currency | Commission | Minimum | Debit Interest for Long Positions | Credit Interest for Short Positions |

|---|---|---|---|---|---|

| Eurozone | EUR | 0.10% | 4.00 EUR | 6.365% | 1.365% |

| USA | USD | 1 cent per CFD | 2.00 USD | 7.83% | 2.83% |

| Australia | AUD | 0.05% | 6.00 AUD | 6.623% | 1.623% |

| Switzerland | CHF | 0.10% | 4.00 CHF | 3.787% | -0.213% |

| Czech republic | CZK | 0.25% | 100.00 CZK | 9.096% | 1.096% |

| Denmark | DKK | 0.10% | 60.00 DKK | 5.986% | 0.986% |

| UK | GBP | 0.10% | 4.00 GBP | 7.647% | 2.647% |

| Japan | JPY | 0.10% | 500.00 JPY | 2.5% | -1.596% |

| Norway | NOK | 0.10% | 60.00 NOK | 6.898% | 1.898% |

| Sweden | SEK | 0.10% | 40.00 SEK | 6.267% | 1.267% |

INDEX CFDs

As of: 14.05.2024

Contract interest is calculated daily for all open CFD positions held at the close of trading.

Starting August 1, 2018 an additional spread of 1% will be added to the rates below for clients classified as retail clients under MIFID.

| CFD Index Country | Currency | Commission | Minimum | Debit Interest for Long Positions | Credit Interest for Short Positions |

|---|---|---|---|---|---|

| Germany 40 | IBDE40 | 0.01% | from 2.00 Euro | 6.365% | 1.365% |

| Euro 50 | IBEU50 | 0.02% | from 2.00 Euro | 6.365% | 1.365% |

| France 40 | IBFR40 | 0.02% | from 2.00 Euro | 6.365% | 1.365% |

| Spain 35 | IBES35 | 0.02% | from 2.00 Euro | 6.365% | 1.365% |

| Netherlands 25 | IBNL25 | 0.02% | from 2.00 Euro | 6.365% | 1.365% |

| US 30 | IBUS30 | 0.01% | from 2.00 USD | 7.83% | 2.83% |

| US 500 | IBUS500 | 0.01% | from 2.00 USD | 7.83% | 2.83% |

| US Tech100 | IBUST100 | 0.02% | from 2.00 USD | 7.83% | 2.83% |

| Australia 200 | IBAU200 | 0.02% | from 2.00 AUD | 6.623% | 1.623% |

| Switzerland 20 | IBCH20 | 0.02% | from 2.00 CHF | 3.787% | -0.213% |

| UK 100 | IBGB100 | 0.01% | from 2.00 GBP | 7.647% | 2.647% |

| Hong Kong 500 | IBHK50 | 0.02% | from 2.00 HKD | 6.479% | 1.479% |

| Japan 225 | IBJP225 | 0.02% | from 2.00 JPY | 2.5% | -1.596% |

FOREX CFDs

Status: 14.12.2022

As of August 1, 2018, an additional spread of 1% will be applied at the rates below for customers classified as retail investors under MIFID.

Favorable margin requirements for CFDs

CFDs are global products and are not associated with any particular country or region. The section below explains the margin requirements, but these may be subject to change depending on the regulations of regional regulators.

POWERFUL CFD TRADING TOOLS

Our trading platforms offer a wide range of functions for CFD trading that meet the needs of different CFD traders. Whether you want to trade directly via the most powerful platform, the Trader Workstation (short: TWS), the FXTrader or flexibly via the CapTrader App, with our trading platforms you trade CFDs at any place and at any time as you want.

Trading platform stable even in turbulent stock market times

Free professional trading tools

Excellent trading app available for iOS & Android

OPPORTUNITIES AND RISKS OF THE CFD TRADE

Opportunities of CFD trading

Low margin, high leverage

The low margin requirements allow you to build even large positions with little capital invested. Due to the leverage effect when trading CFDs, you can achieve high profits even with a small capital investment.

Diverse offer

CFDs can be traded worldwide on stocks, indices, ETFs, commodities, currencies and other underlying assets. This diverse range of contracts for difference offers a wide variety of investment opportunities.

High flexibility

With CFDs you can easily build long and short positions to profit from both rising and falling prices of the underlying asset. This allows you to react particularly flexibly to any market situation.

Tax advantage

In some countries, a stock exchange turnover tax is charged on the trading of shares. By trading CFDs as an alternative, this can sometimes be avoided.

Risks of CFD trading

Risk of loss

CFD prices are subject to constant fluctuations and an investment in CFDs can lead to high losses

Financing costs

When CFDs are held overnight, financing costs are incurred on the leveraged capital. These financing costs reduce the profit or increase the loss.

Leverage risk

Due to the leverage effect of CFDs, price fluctuations in the underlying have a more extreme effect and are many times higher. This can result in high losses even with low capital investment.

Currency risk

When investing in CFDs in foreign currencies, there are currency risks that can negatively affect the performance of the trade.

OPEN A SECURITIES ACCOUNT NOW AND TRADE CFDS PROFESSIONALLY

Trade CFDs on stocks, currencies/forex, indices as well as metals with a variety of underlyings at CapTrader.

CFD trading at favorable and transparent conditions at CapTrader.

FREQUENTLY ASKED QUESTIONS ABOUT THE CFD TRADE

For more information, please visit our Help Center

What is a DMA Broker?

Pure CFD brokers usually act as so-called market makers (MM brokers) and thereby determine the trading volume and the prices at which securities are bought (ask price) and sold (bid price) themselves. Disadvantage for the customer: in practice, it is not always transparent how the broker's pricing works.

Also, this type of pricing then occasionally results in sharp price swings (the so-called spikes), which do not occur on the exchange where the underlying asset of the CFD is traded.

CapTrader as a DMA broker (DMA=Direct Market Access), on the other hand, allows its clients to trade directly in the order book of the lead exchange. DMA trading with CFDs therefore means that you trade with the same tight spreads that the underlying (the stock, the index, etc.) has on the reference exchange.

As a transparent and fair DMA broker, we do not charge any surcharges or artificially widen the spreads. This is therefore very advantageous for you as a customer when trading leveraged contracts for difference, as even the smallest changes in the spread can have a strong impact on possible profits or losses due to the leverage.

Will I receive a dividend if the share of the CFD pays it out?

Stop at the Ex-dividend day CFDs on this share, you will automatically receive the dividend as a credit to your CapTrader account. This credit of the cash amount is of course free of charge for you.

What are the requirements for CFD Margins?

The margin for CFDs consists of the specifications of the broker and the European Securities and Markets Authority (ESMA), whereby the higher requirements are applied in each case. As with other investment products, the margin changes according to the current risk assessment of the broker. Therefore, you will always be shown the current margin requirement before placing your order.

Do I have to pay interest daily when trading CFDs?

Financing costs for CFDs:

Daily interest will be charged to your account for open long positions.

For open short positions, interest is usually credited to your account on a daily basis, except in cases where there is a negative contract interest rate. If the contract interest rate is negative, your account will be debited with this interest.