Dear traders, dear stock market friends.

We are currently in a bull market. Typical of a bull market is the fact that share indices reach new highs at short intervals. This is also the case with the DAX at the moment. The leading German index is climbing to one new all-time high after another and is testing the patience of all those who are not participating in the rally.

Whether the rally is fundamentally justified or not seems to be of secondary importance. The bull market feeds the bull market and the DAX proves why a trend-following approach is the only sensible strategy for traders and investors in the current market environment. Last week's generally positive sentiment was due not least to Nvidia's quarterly results, which led to a kind of buying frenzy for AI shares in the US and also rubbed off on the German stock market.

New record highs

After the DAX was still treading water in the first half of the week, a renewed rally followed on Thursday and Friday, pushing the DAX to a new all-time high of 17,419 points on a daily closing price basis. On a weekly basis, the DAX gained 302 points or 1.76 %. Since the beginning of the year, the index has already risen by around 4 %.

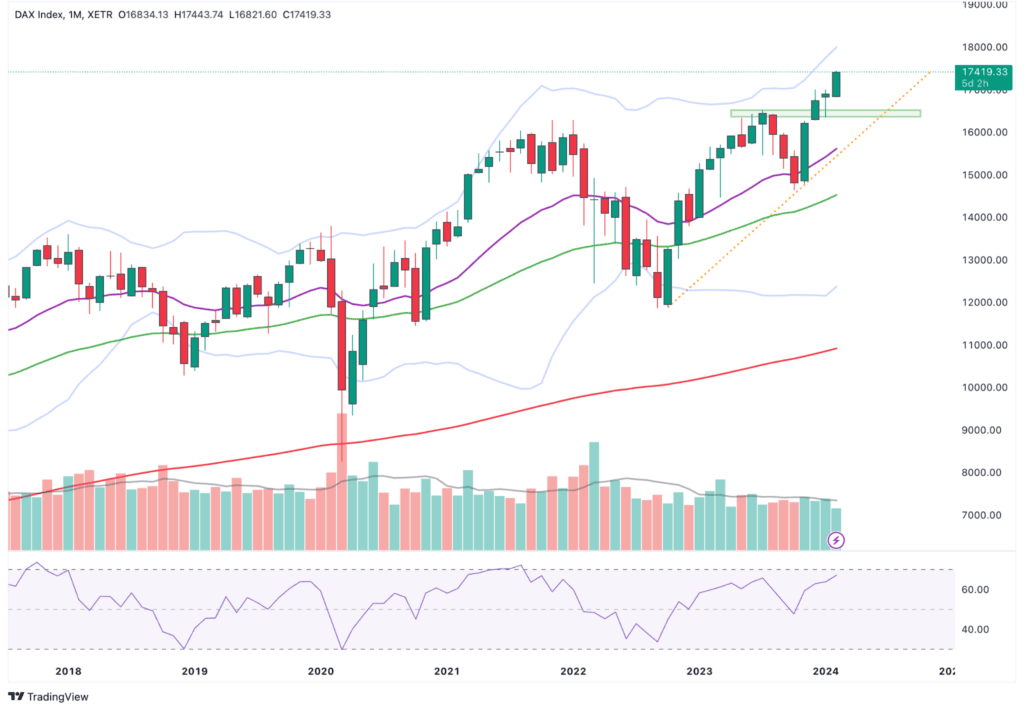

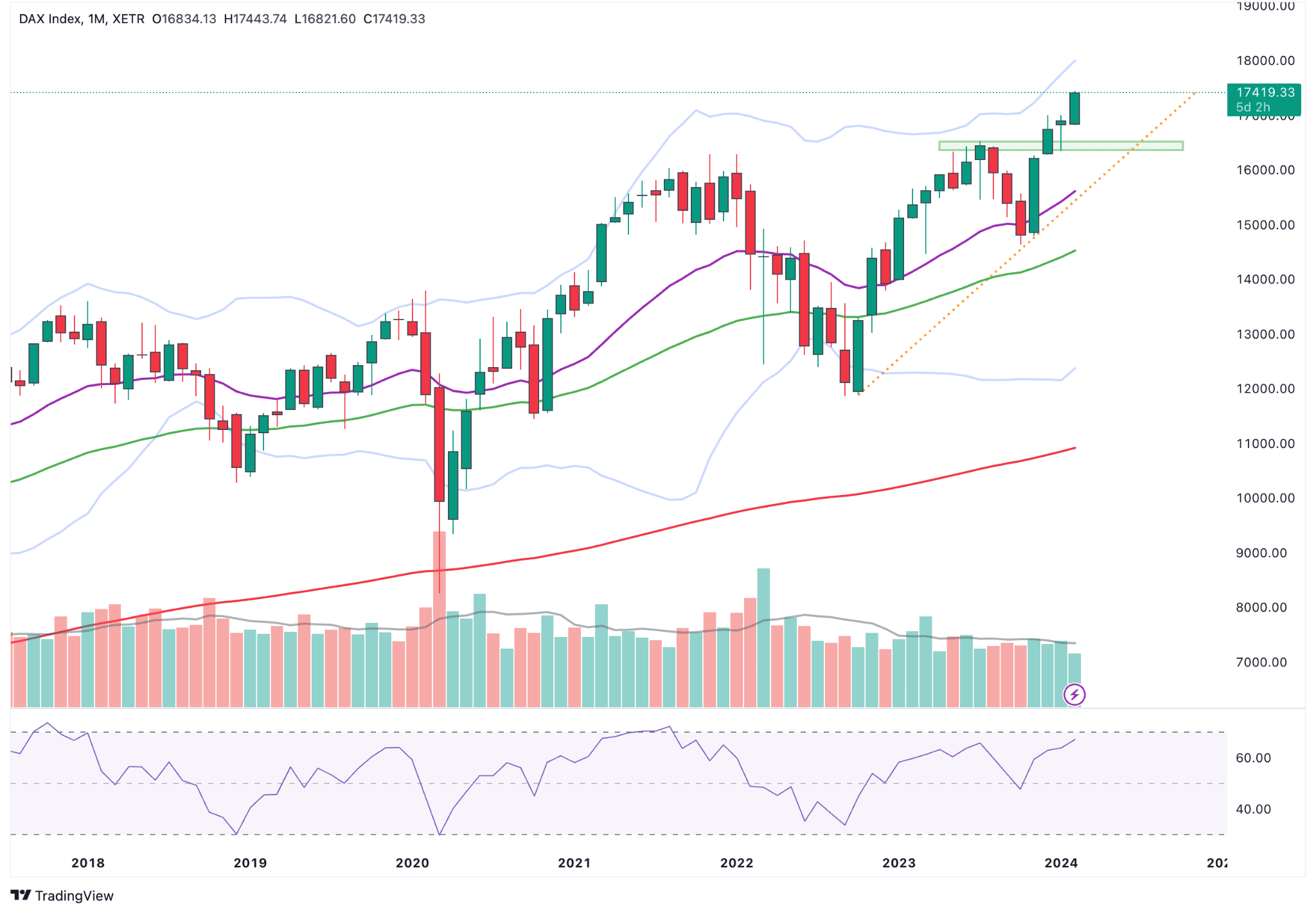

A look at the monthly chart shows that the breakout above last year's high can be considered successful or confirmed. In the event of a correction, the old annual and all-time high of around 16,500 points therefore represents an important support area.

DAX Index monthly chart

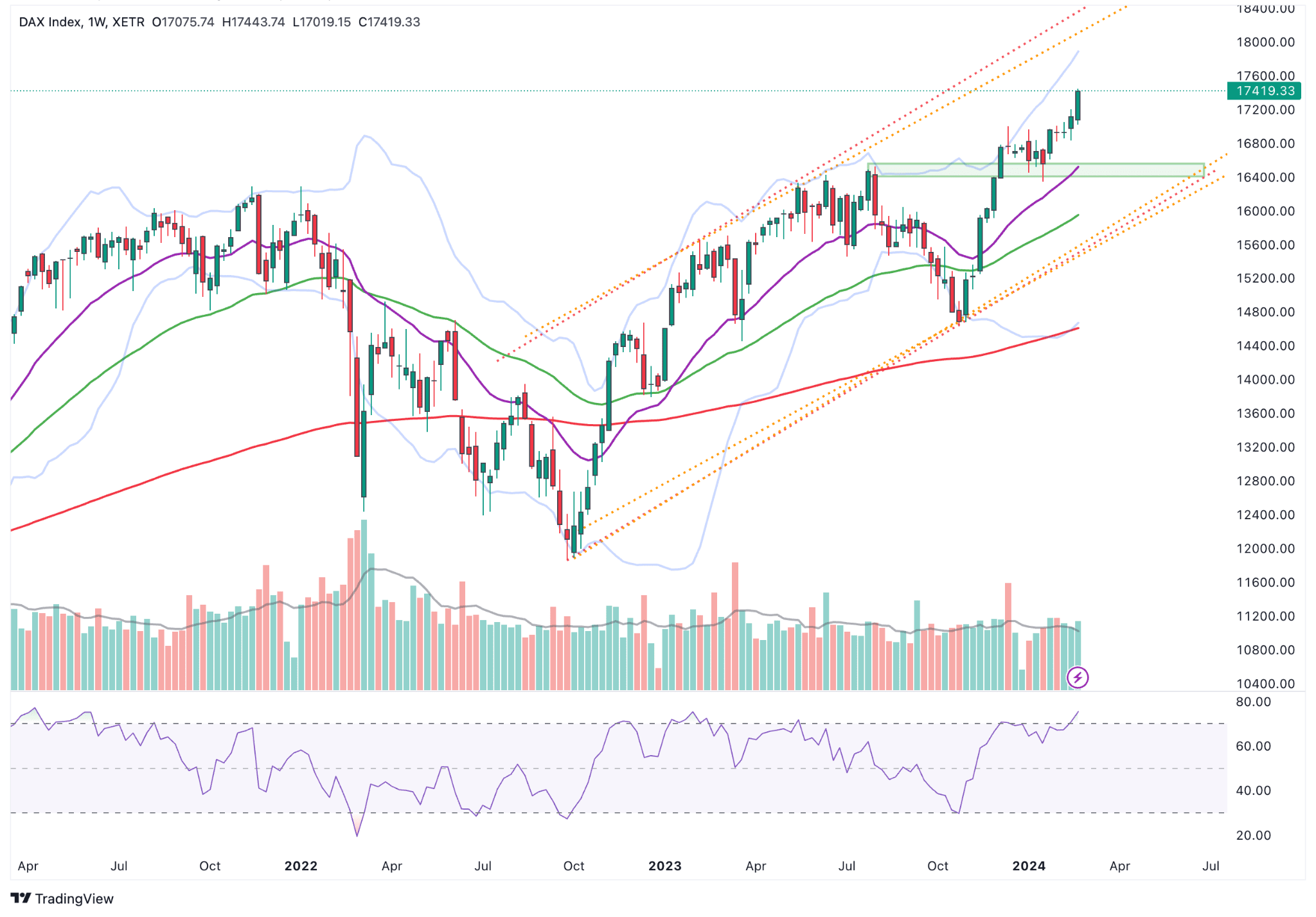

18,000 points mark in sight

Now that the DAX has left the round 17,000 mark behind it, there is still some room for upward movement, at least in chart terms. The next psychological resistance could be lurking in the 18,000 points area, in conjunction with the upper Bollinger band on a weekly basis and the trend channel boundary line. However, jumping on the bandwagon now seems risky in the short term, at least from a risk/reward perspective, as the market remains heavily overbought, as can be seen in the weekly RSI, among other things.

DAX Index weekly chart

The weekly chart also makes it clear that the support zone at 16,400 - 16,500 points would represent a very attractive entry level in chart terms.

Tailwind from the USA

The DAX is currently also being supported by a positive overall market sentiment, which is based on various factors. The rapid progress made in the field of artificial intelligence in the last one to two years is a price driver that should not be underestimated and is partly responsible for the current bull market.

Last week, the publication of Nvidia's quarterly figures made headlines. Nvidia is one of the leading companies in the field of artificial intelligence and the positive results once again fueled the AI hype and put investors in a buying mood. This also spilled over to the European stock markets on Thursday and Friday, which is one explanation for the positive performance on Thursday and Friday.

Outlook for the coming week

In terms of news, the focus in the coming week (especially in the second half of the week) will be on economic, labor market and inflation data as well as quarterly results from various companies. On Thursday morning at eight o'clock, retail sales for January will be published. Provisional consumer price data will follow in the afternoon at 2 pm. A further fall in the inflation level to 2.6 % is expected, following a value of 2.9 % in the previous month. The Purchasing Managers' Index for the manufacturing sector, which is an important indicator for industry, will follow at 9:55 on Friday morning. With values below 50 points, it has signaled a negative trend in recent months.

On Friday morning at 11 a.m., consumer prices for the eurozone as a whole will be published for February. After an inflation rate of 2.8% in the previous month, a further fall to 2.5 % is also expected here. Consumer prices attract a great deal of attention as they also play an important role in the expected interest rate cuts by the European Central Bank this year.

Author Tobias Schmid

Date: 26.02.2024