EVEN WITH FALLING SHARE PRICES GAIN PROFITS

Prices on the stock markets are rising and you can realize price gains with the shares you have bought. But what options do you have if the shares fall? With your purchased shares (long positions) you make losses in this case. With short selling, on the other hand, you can generate profits even if stock prices fall. Learn more about what short selling is and how you can implement it at CapTrader.

With the help of two examples, we would like to show you what options you have with a short sale in the case of different price trends of your shares.

Initial situation: Your shares of the short sale AG (fictitious company) are currently quoted at a stock market price of 500 USD per share.

You now make a short sale of 10 shares because you expect prices to fall in the future and then want to buy back the borrowed shares at a later date.

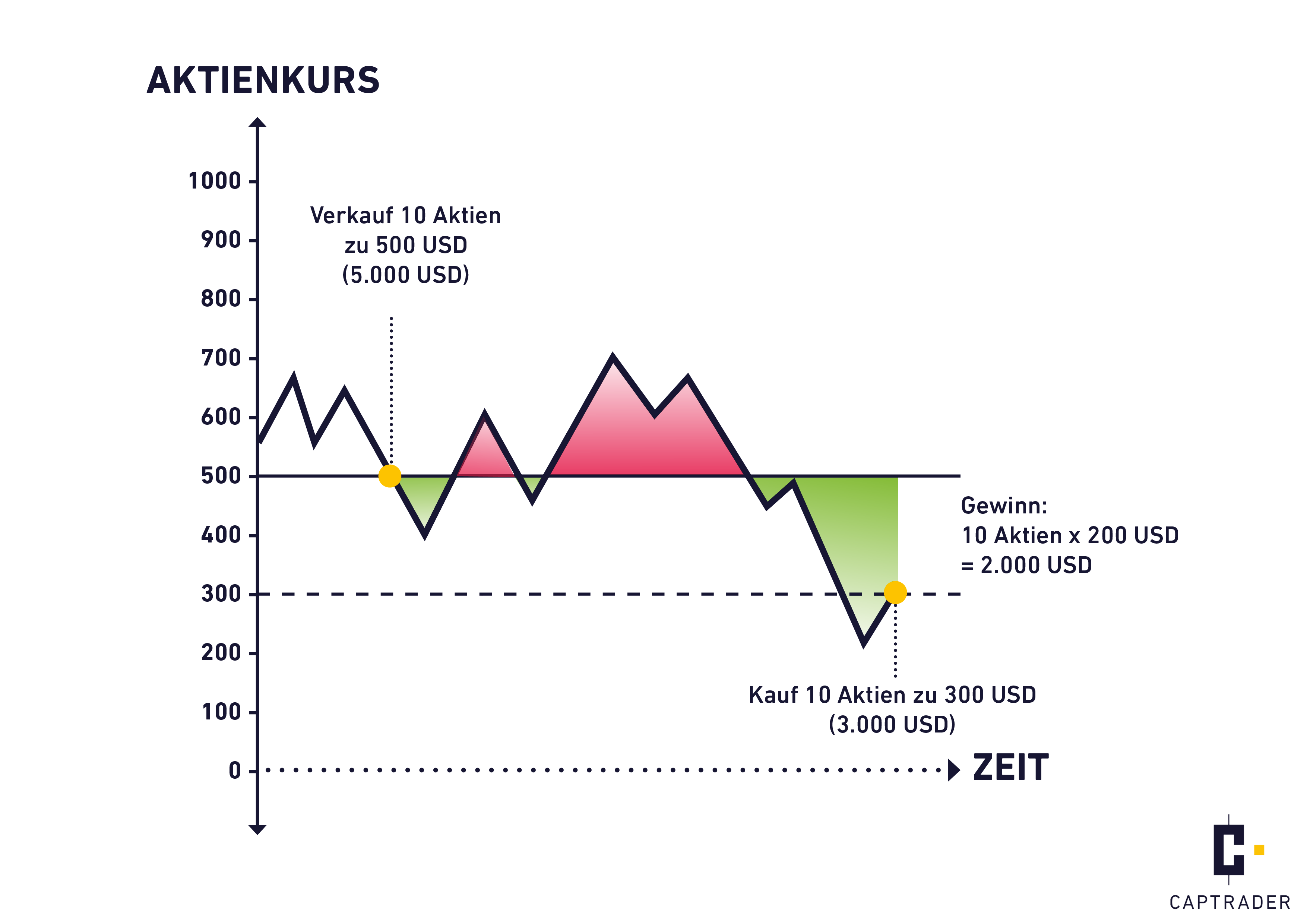

Scenario 1: Short sale of shares at a profit

After your short sale, your stock falls below your selling price and you buy back the shares at a price of 300 USD per share (this is also called closing out a stock). Since the price of the share has fallen, you now pay only USD 3,000 for the purchase (price 300 x 10 shares= USD 3,000).

So you made a profit of $2,000 (order fees and lending rate excluded in this example) because you received $5,000 for the short sale but only had to pay $3,000 when you bought back the shares.

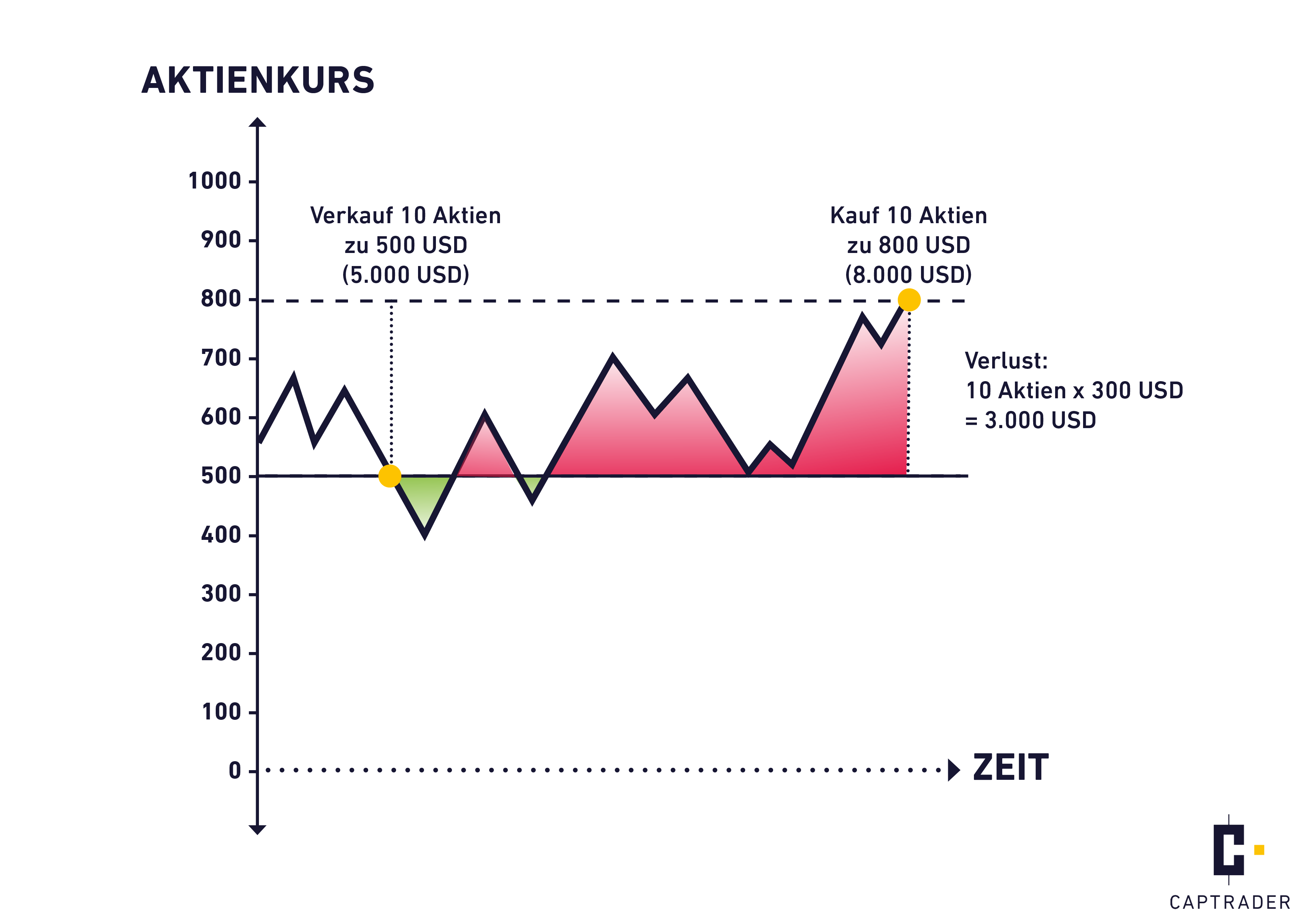

Scenario 2: Short sale of shares at a loss

After your short sale, your stock rises above your selling price and you buy back the shares at a price of 800 USD per share (this is also called closing out a stock). Since the price of the stock has risen, you now pay USD 8,000 to buy it (price 800 x 10 shares= USD 8,000).

So you made a loss of $3,000 (order fees and lending rate excluded in this example) because you received $5,000 for the short sale but had to pay $8,000 when you bought back the shares.

THESE ARE EMPTY SALES (SHORT-SELLING)

The sale of securities, commodities or foreign currencies that a seller does not own is referred to as short selling, short selling, shorting or short trading. Short sales are possible both on the spot market and on the futures market.

A short seller assumes that prices will fall and speculates that he will be able to buy the securities sold at a later date at a lower price..

The price difference between the selling price and the buying price is the short seller's profit or loss. For example, in order to sell shares or other securities short on the cash market, a securities lending transaction is usually entered into. In the futures market, the position sold short must either be closed out by a timely offsetting transaction, or the seller must either deliver goods or make a cash settlement at a later date.

OPEN A SECURITIES ACCOUNT NOW AND SHORT SELLING

With the online custody account at CapTrader, you can survive even turbulent stock market phases.

Take advantage of short selling as well as SmartRouting, which allows you to always buy and sell shares at the best price and with particular ease.

FREQUENTLY ASKED QUESTIONS ABOUT EMPTY SALE

For more information, please visit our Help Center.

How to place short sales in Trader Workstation TWS, the app and account management?

At CapTrader there are several trading platforms available for you to trade. In each trading software you can make short sales. To show you the simplicity of these trades at CapTrader, we have provided you with two videos that demonstrate the Short sale in the Trader Workstation TWS as well as in the Account management (Client Portal) and the Trading App by means of various practical trades.

Opportunities from short selling

- As a short seller, you have the opportunity to profit from falling prices on the markets and thus create more room for maneuver, especially in stock market phases in which share prices tend to fall.

- At CapTrader, you as a buyer of shares can lend your shares to other traders and make them available for short sale. You then generate an additional return for your securities account, as you share in the interest rates for lending. More information about the Stock Return Optimization Program can be found at here.

- At CapTrader you can hedge your portfolio by short selling to minimize the portfolio risk. Thus, you then use the short sale as a way to hedge.

Risks of short selling

- Since a share price can theoretically also rise indefinitely, a short sale is also associated with high risks. The losses are therefore theoretically not limited. In this case, the margin system takes effect, which limits the risk to the value of your securities account. Even more risky than the short selling of shares is the short selling of leveraged products. Here, the risk of loss can increase due to the respective leverage.

- As a short seller, you pay interest to the owner of the shares for the period of the short sale. The cost of borrowing shares can vary widely. The annualized interest rate can range from a few percentage points to, for "hard-to-borrow" stocks, over 100% of trading volume. The borrowing rate is set by the broker and depends, among other things, on the liquidity of the stock, the volume traded, and the current market conditions. The lending fees are variable and fluctuate daily.

Of course you can find the current rental rate at any time in any of our tarding platforms. We also show you these in the two videos at the top of this page. - The short seller is responsible for paying dividends to the lender of the stock should they accrue during the period of the short sale. These are basically not real dividends, but compensation payments from the short seller to the lender.

- At CapTrader, short selling can only be done on the margin account type. Should you use margin here, interest must be paid on the borrowed amount. Especially long held positions can bring costly interest.

- Short Squeezes & Buy-Ins

Stocks with a high short interest may occasionally experience a large increase in price - typically when a positive development of the stock is expected and many short sellers close out their positions. A buy-in can occur if there are no more shares available to borrow. If the owners of the shares want to sell their shares themselves or are no longer willing to lend the shares and the broker can no longer find shares that can be lent, the short position is closed out. This can happen at any time and lead to unexpected losses. - Regulatory risks

Regulators may prohibit short selling of stocks to avoid panic selling, as well as unjustified sell-offs. This can lead to sudden spikes in stock prices and thus to short positions with high losses.