USA

For the USA, the W8-BEN form Application. Here, an advance reduction of 30 % from 15 % for Ordinary Dividends for shares and ETFs applies for a dividend receipt due to the double taxation treaty.

Important: Every securities account opened with CapTrader (private or corporate) has the W8-BEN form already filled in automatically in the account application. So there is no need to apply for the W8-BEN form separately here. However, you will be asked from time to time to update your tax relevant data.

Exceptions:

- Dividends from limited partnerships (LPs) and master limited partnerships (MLPs) are subject to 39.6 % withholding tax deduction.

- Return of capital from REITS (non-ordinary dividends) may be subject to different rates depending on the type of structure.

AUSTRALIA, CANADA & ISRAEL

For these three countries an advance reduction is also possible at CapTrader. For Australia this is a reduction from 30 % to 15 %, for Canada from 25 % to 15 % and for Israel from 30 % to 10 % via the CRS Individual form (see below).

Exceptions:

- Australia: certain dividends (e.g. franked dividends and conduit income) are not subject to withholding tax, so a rate of 0 % is applied.

- Canada: REITs in the legal form of a trust (often identifiable by the symbol ending with "UN" in the TWS) distribute so-called "other income" to which a non-reducible rate of 25 % applies.

GUIDE TO OBTAINING WITHHOLDING TAX REDUCTIONS - INSTRUCTIONS.

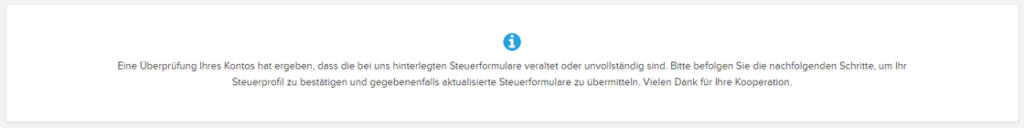

First of all, the Trading authorizations for shares of the corresponding country must be requested. Then the account management (Client Portal) automatically determines that the tax forms need to be updated:

Provided that the trade authorizations are already in place, you can also complete your tax forms afterwards.

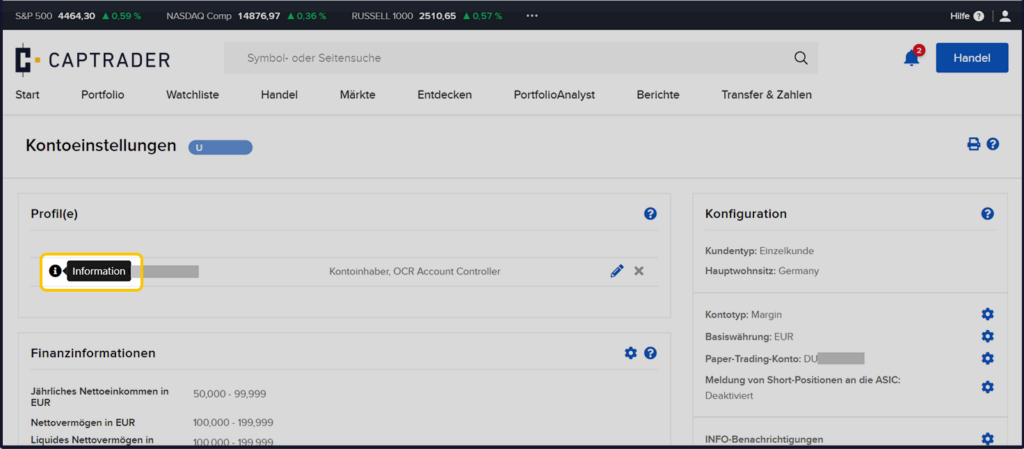

To do this, please first check if there is an open item (Pending Item) under the bell icon on the top right. If this is not the case, please go to the account settings and click there on the blue "i" symbol in front of your name.

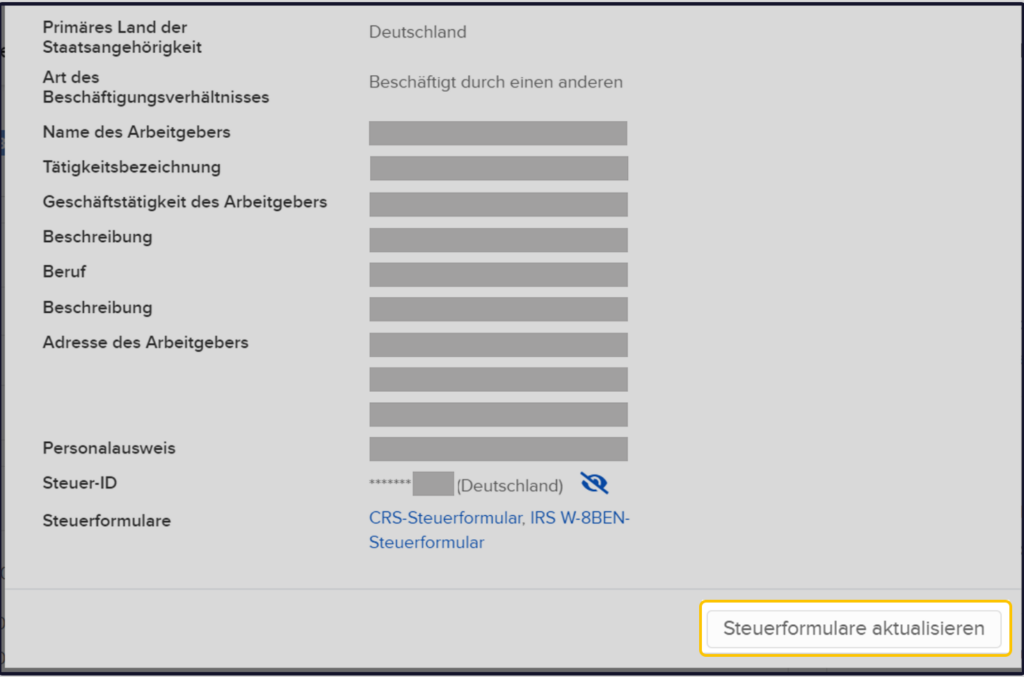

There you will see the "CRS Tax Form" (in English "CRS Individual") in blue letters:

After you click on "CRS tax form", you need to click on the button > Update tax forms at the bottom. After that, please go through the general personal data.

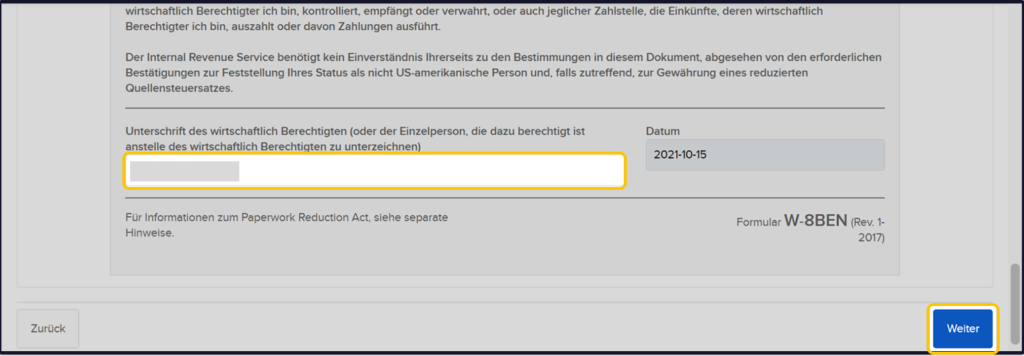

The W8-BEN form for U.S. Withholding Tax Advance Reduction will then appear and must be signed again.

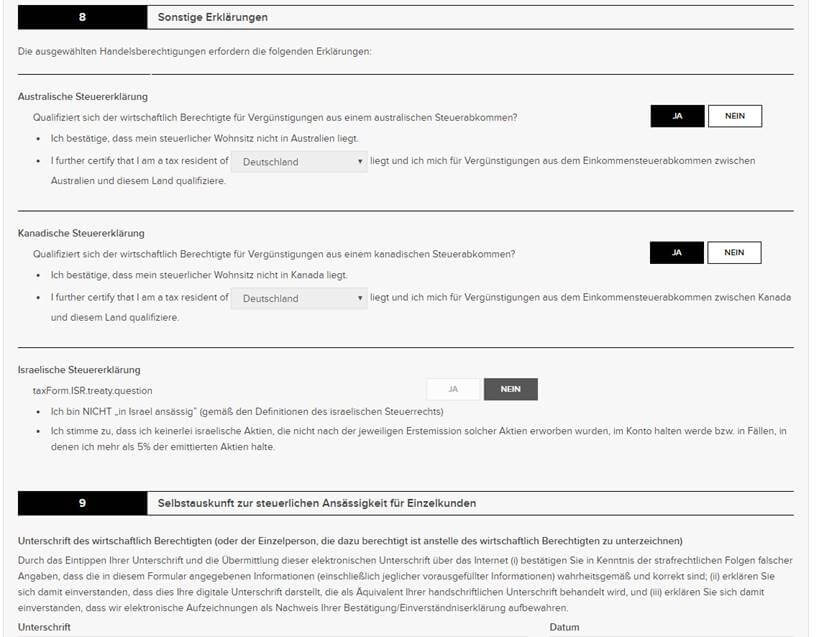

Another form for "Self-disclosure of tax residency" then appears. If you scroll down here, you will see "CRS-Individual" at the bottom right. Part 8 is then relevant in this form:

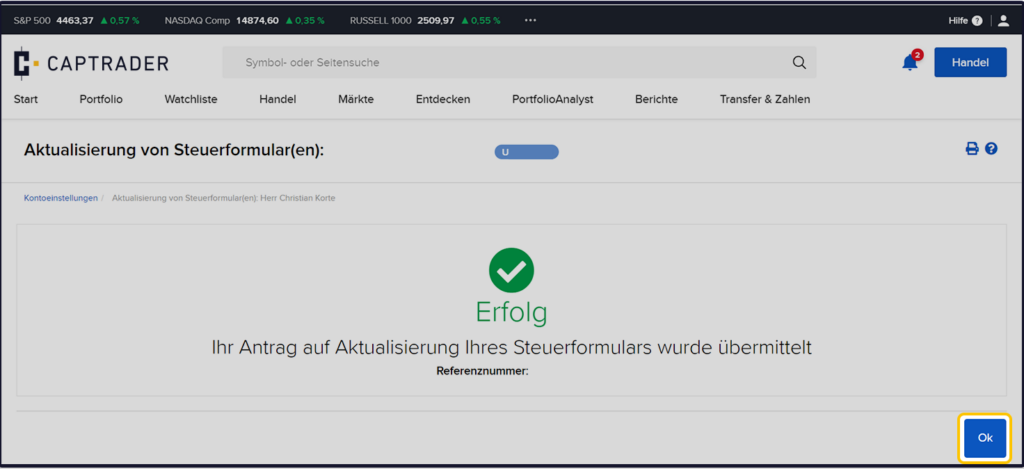

Now confirm the process with your virtual signature and click the >OK button to finish.